Latin America has witnessed a significant transformation in recent years, with the emergence of a growing middle class that is reshaping the region’s socio economic landscape. A notable trend within this transformation is the rise of a financially empowered age group—those between 30 and 40 years old—who are experiencing increased wealth and a greater capacity for savings. This demographic shift has led to a surge in investment activities, particularly in digital platforms. However, despite the enthusiasm for digital investing among the middle class, the technological infrastructure and readiness of the industry in Latin America present challenges in fully serving this new generation of investors.

The Growth of the Middle Class in Latin America

Over the past decade, Latin America has experienced substantial economic growth, accompanied by declining poverty rates and a notable expansion of the middle class. The region’s middle class, traditionally defined by its consumption patterns, is now characterized by a growing emphasis on savings, investments, and financial planning. The age group of 30 to 40-year-olds, in particular, has become a significant driver of this trend, benefiting from increased educational opportunities, professional growth, and access to credit.

The rise of the middle class in Latin America has led to improved living standards and increased disposable income for many individuals within this demographic. As a result, people aged 30 to 40 now have a greater capacity to save and invest their money. This shift in financial capability has ignited a growing interest in wealth accumulation and long-term financial planning, prompting individuals to seek out investment opportunities beyond traditional avenues.

While there is a clear demand for digital investment platforms in Latin America, the region’s digital offering still lags behind more technologically advanced markets. Several factors contribute to this technological gap:

- Limited Digital Infrastructure: Latin America faces challenges related to inadequate internet connectivity and a lack of reliable digital infrastructure, which hampers the development and accessibility of robust online investment platforms.

- Regulatory Environment: Regulatory frameworks in some Latin American countries have not fully adapted to the emergence of digital investment platforms. This mismatch creates uncertainty and hinders the growth of the industry, making it difficult for new platforms to establish themselves and expand their offerings.

- Trust and Education: Building trust and fostering financial literacy among the middle class are crucial aspects of successful digital investment platforms. Many individuals in Latin America still harbor skepticism toward digital financial services, preferring traditional brick-and-mortar institutions. Moreover, financial education efforts need to be strengthened to enable individuals to make informed investment decisions.

Latin America’s investor landscape, particularly in countries like Brazil, has witnessed a growing dissatisfaction among investors with both traditional banks and digital investment platforms. Several key factors contribute to this discontent, including a lack of robust digital offerings, limited access to offshore investment products, and the need for personalized investment solutions. Addressing these concerns presents an opportunity for financial institutions to enhance their services and better cater to the evolving needs of investors in the region.

- Lack of Digital Offering: one of the primary sources of dissatisfaction among investors in Latin America is the limited digital offering provided by both traditional banks and digital investment platforms. Many investors seek the convenience and flexibility of digital solutions to manage their investments, track performance, and access information on-the-go. However, the region’s financial industry has been relatively slow in developing comprehensive and user-friendly digital platforms that meet these expectations.

To address this issue, financial institutions need to invest in technological infrastructure, user-centric design, and intuitive interfaces. This includes offering user-friendly mobile applications, online investment portals, and digital tools that provide real-time portfolio tracking, investment analysis, and educational resources. By embracing digital transformation, banks and investment platforms can improve investor satisfaction by delivering seamless and convenient digital experiences.

- Lack of Access to Offshore Investment Products: investors in Latin America, especially in countries like Brazil, often express frustration due to limited access to offshore investment products. Offshore investments offer diversification opportunities, exposure to international markets, and access to specialized investment vehicles. However, regulatory restrictions and complex tax implications in some Latin American countries can hinder investors’ ability to invest offshore.

To address this challenge, financial institutions and regulatory bodies can collaborate to develop streamlined processes and regulatory frameworks that facilitate access to offshore investment products. This includes simplifying procedures for investors to remit funds abroad, establishing partnerships with international investment firms, and providing educational resources to investors regarding offshore investment options. By broadening the range of investment products and opportunities, banks and digital platforms can cater to the diverse needs of investors and enhance their satisfaction.

- Personalization of Investment: investors in Latin America increasingly demand personalized investment solutions tailored to their unique financial goals, risk profiles, and preferences. They seek investment platforms and advisory services that can provide customized recommendations, personalized portfolio management, and tailored investment strategies. However, many traditional banks and digital platforms offer limited personalization options, relying on standardized investment models and products.

To address this concern, financial institutions should leverage technology and data analytics to deliver personalized investment experiences. Utilizing algorithms and artificial intelligence, banks and digital platforms can analyze investor profiles, investment preferences, and market trends to offer tailored investment recommendations. Additionally, providing access to human advisors who can understand and address investors’ specific needs can further enhance the personalization of investment services.

Investor dissatisfaction in Latin America, particularly in countries like Brazil, presents both challenges and opportunities for financial institutions. By recognizing the importance of robust digital offerings, addressing the lack of access to offshore investment products, and focusing on personalized investment solutions, banks and digital platforms can better serve their investor base and improve overall satisfaction.

Investing in technological infrastructure, collaborating with regulatory bodies, and fostering a customer-centric approach will be instrumental in meeting investor expectations. By doing so, financial institutions can build stronger relationships with investors, foster long-term loyalty, and position themselves at the forefront of the evolving investment landscape in Latin America.

The Evolution of Independent Financial Advisors in Latam

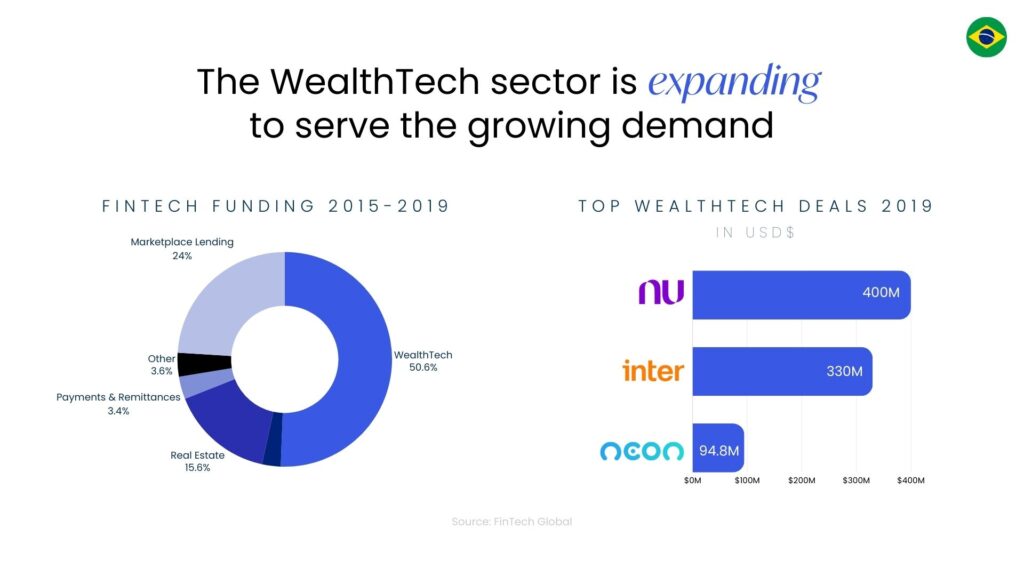

As seen in the previous graph, the number of IFAs has seen a continuous growth; in Brazil for example. Advisors from private banks are starting to shift to an independent model where they can sell a wider range of products with a better customer experience. Nevertheless, the lack of digital structure can be a big obstacle for future growth in this new sector. Optimizing resources and providing excellent service are two goals every advisor has, and with the current environment they can get harder to achieve. But there is good news, countries like Brazil are focusing on the FinTech sector with more emphasis; specifically the WealthTech sector. Even though they are mostly focused on the B2C sector for traders, the support for independent advisors is expected to grow in the technological side.

Citec’s Proposal for This Issue

Understanding that there is a growing market not only for middle class investments, but for WealthTech products, Citec can now support more and more clients. With our E2E platform IFAs can handle multiple portfolios in the same place. Reducing research, operational and reporting costs. And being able to create tailored portfolios to improve their customer experience. Products like our Portfolio Builder now support the Latin American market. While investors who focus on offshore investing also have a wide range of options.