The financial advisory market in the United States is experiencing a dynamic shift, driven by technological advancements, regulatory changes, and evolving client preferences. With an increasing focus on financial well-being and long-term wealth management, individuals and households are seeking professional guidance to navigate the complexities of investment, retirement planning, and financial goal attainment.

In recent years, the United States has witnessed significant growth in the financial advisory sector, reflecting the changing needs of investors and the broader economic landscape. According to industry reports, the market size of financial advisory services in the United States surpassed $60 billion in 2022, a remarkable increase of over 20% compared to the previous year.

The advent of digital platforms and robo-advisors has revolutionized the financial advisory landscape, making investment advice and portfolio management more accessible to a broader range of individuals. These technology-driven solutions offer low-cost investment options, personalized advice, and streamlined processes, enticing both traditional investors and a new generation of tech-savvy clients.

Emerging Trends Ahead: What is the future of the financial advisory market looking like?

As the financial advisory market in the United States undergoes a transformative phase, several emerging trends are reshaping the industry landscape. These trends reflect the changing dynamics of client needs, advancements in technology, and evolving market forces. Furthermore, industry forecasts project substantial growth for the financial advisory sector in the coming years. This section explores these emerging trends and provides insights into the forecasted growth of the market.

Rise of Hybrid Advisory Models:

One prominent trend in the financial advisory market is the emergence of hybrid advisory models, blending digital platforms with human expertise. This approach combines the convenience and efficiency of technology-driven solutions with the personalized guidance and relationship-building aspects offered by traditional financial advisors. By leveraging algorithms, data analytics, and artificial intelligence, hybrid models provide tailored investment recommendations, automated portfolio rebalancing, and ongoing monitoring while maintaining a human touch when addressing complex financial situations. This hybridization is expected to gain traction, with industry forecasts projecting a compound annual growth rate (CAGR) of over 12.64% for hybrid advisory services over the next five years.

Focus on Sustainable and Responsible Investing:

Environmental, social, and governance (ESG) considerations have become increasingly important for investors, and the financial advisory market is witnessing a surge in demand for sustainable and responsible investment options. Clients are seeking advisors who can align their investment strategies with their values, integrating ESG factors into portfolio construction and decision-making. This trend is expected to continue growing as investors prioritize long-term sustainability and ethical investing practices. Industry projections indicate that sustainable investing will reach over $53 trillion in assets under management in the United States by 2025, underscoring the significance of this emerging trend.

LatAm ESG Trend:

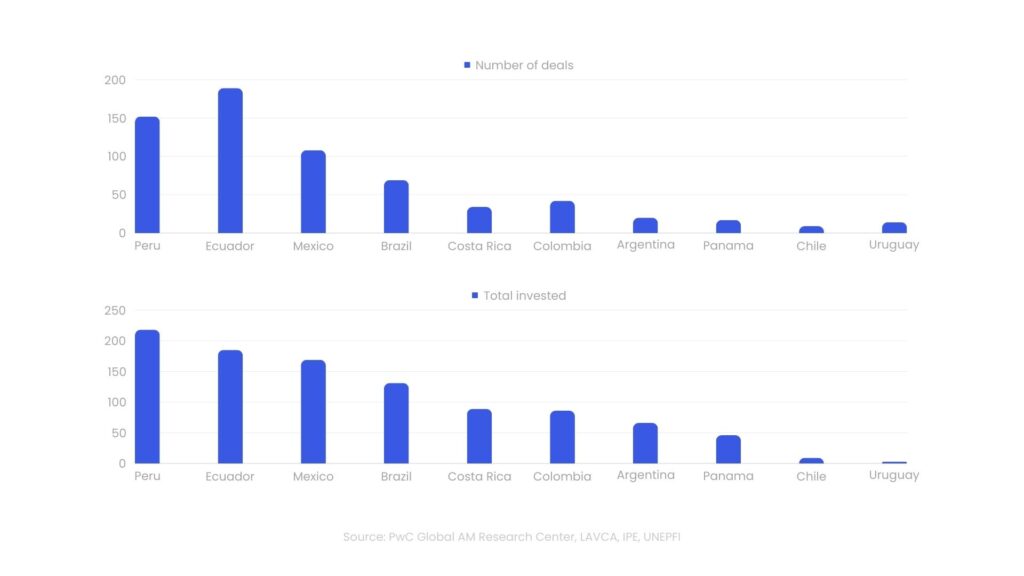

Globally, it is clear that environmental, social and corporate governance (ESG) investing has moved from niche to mainstream. The past years have shown that, when applied effectively, ESG analysis can be a driver of strong investment performance. An increasing number of investors are now demanding a better understanding of how their portfolios are contributing to ESG matters and are looking to increase their allocations in this area. Nowhere is the importance of sustainability more acknowledged by institutional investors than in Latin America, where 75% believe the issue will become more important in the next five years, beating out Europe (74%), North America (63%) and Asia (59%).30 As demand has skyrocketed, asset managers have responded by offering a number of ESG-related products and services. In October 2018, global AuM held in ESG funds surpassed the US$1 trillion mark and has continued to rise. The following table shows ESG number of deals and total investment in US$M in LatAm region:

Increasing Demand from Younger Generations:

Younger generations, particularly Millennials, are poised to become a significant driving force in the financial advisory market. As these cohorts accumulate wealth and face complex financial decisions, they seek advisors who understand their unique needs and preferences. This tech-savvy demographic values digital platforms, seamless user experiences, and socially conscious investing. To cater to this growing client base, advisors are adapting their practices by incorporating digital tools, leveraging social media for engagement, and providing educational resources tailored to the younger generation’s financial goals and aspirations.

Change in Money and Technology: Meeting the expectations of the new generation

As wealth transitions to a new generation, the financial advisory market faces the task of understanding and meeting the unique expectations of Millennials and Generation Z. These younger cohorts, born in the digital age, have distinct attitudes toward money and possess a strong affinity for technology. As they seek financial guidance, their demands are shaping the industry in profound ways.

Technology as a Necessity:

Unlike previous generations, Millennials and Generation Z have grown up immersed in technology. They view it not just as a convenience but as an essential tool for managing their finances. These tech-savvy individuals demand digital platforms that provide seamless access to financial information, account management, and investment options. They expect intuitive mobile apps, user-friendly interfaces, and personalized online experiences that cater to their unique financial goals and preferences.

Embracing Automation and Artificial Intelligence:

Younger generations are comfortable with automation and artificial intelligence (AI) and readily embrace its applications in financial services. They appreciate the efficiency, accuracy, and convenience of robo-advisors, which leverage algorithms to provide automated investment advice and portfolio management. These digital solutions resonate with their desire for cost-effective and easily accessible investment options that align with their financial objectives.

Socially Responsible Investing:

Environmental and social considerations weigh heavily on the minds of younger investors. Millennials and Generation Z show a strong inclination toward socially responsible investing (SRI) and impact-driven initiatives. They desire investment options that align with their values, such as ESG-focused portfolios and sustainable business practices. Advisors who can integrate SRI strategies and communicate the positive impact of investments are well-positioned to attract and retain clients from these generations.

Tech Adoption and Needs: What creates value and simplifies processes for the industry?

In the short term, costs will rise as managers hire new tech-savvy talent, upskill existing workers, and implement new software. Managers must therefore prepare for the initial outlay. Those with scale will be able to use this to their benefit as they leverage their size to mitigate some effects of the cost. Many managers globally have already begun this process of replacing their core systems, often making use of large service providers or technology firms who provide a uniform platform.

WealthTech platforms such as CITEC, have already been working on meeting the tech needs of the newer generation of wealth holders & financial advisors by providing features that add value and relevance to the processes of both clients:

- Portfolio Management

- Reporting and Analytics

- Customization