Environmental, Social, and Governance (ESG) investing has become a hot topic in the investment world in recent years. ESG investing involves incorporating environmental, social, and governance factors into investment decisions. This approach considers the impact of a company’s operations on the environment, the welfare of its employees, and the quality of its management practices. Investors increasingly recognize that ESG factors can impact a company’s financial performance in both the short and long term. In this article, we will discuss the future of ESG, what investors think about it, and how it can benefit companies and investors. We will also describe how our platform can help investors access ESG features such as ESG analytics of their portfolio, ESG filters, and ESG ratings of companies.

The Future of ESG

ESG investing is growing rapidly and is becoming an essential part of investment decision-making. The COVID-19 pandemic has further accelerated the demand for ESG investing, as investors seek companies that are better prepared to manage risks and navigate uncertain times. According to a recent report by Morgan Stanley, sustainable investing assets could reach $50 trillion by 2025. This growth is driven by the increasing recognition that ESG factors are essential to understanding a company’s long-term performance and risks.

Investor Attitudes Toward ESG

Investors are increasingly interested in ESG investing, as they recognize that ESG factors can impact a company’s financial performance. According to a survey by Morningstar, 72% of U.S. investors are interested in sustainable investing. Another survey by BlackRock found that sustainable investing is no longer a niche area, as 88% of institutional investors globally are integrating ESG factors into their investment decisions.

The Benefits of ESG for Companies and Investors

ESG can benefit both companies and investors. Companies that adopt strong ESG policies are more likely to attract investment from socially responsible investors, which can lead to lower costs of capital. ESG factors can also help companies identify risks and opportunities and create a more sustainable future.

For investors, ESG investing can lead to better long-term financial performance by identifying companies that are well-managed and have sustainable business models. Additionally, ESG investing allows investors to align their investments with their values.

Investors are increasingly demanding ESG data and analysis to inform their investment decisions. Our platform offers a range of ESG features that help investors make informed decisions about their portfolios. Here are some of the key ESG features available on our platform:

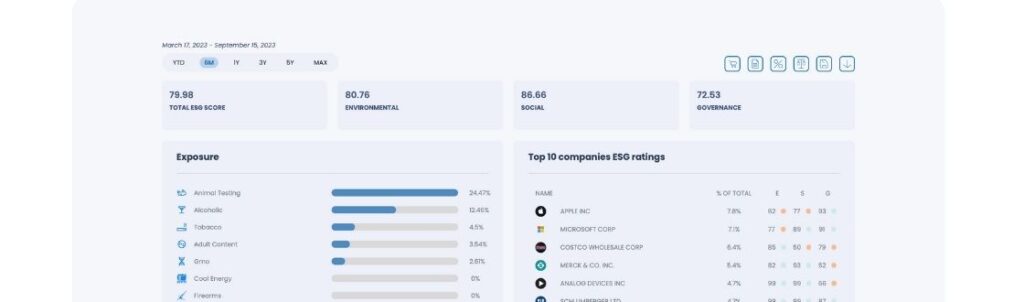

ESG Portfolio Analytics

ESG Analytics of your Portfolio: Our platform offers ESG analytics of your portfolio, providing you with an in-depth analysis of the ESG risks and opportunities in your portfolio. Our analytics use a combination of quantitative and qualitative analysis to provide you with a comprehensive view of the ESG performance of your portfolio.

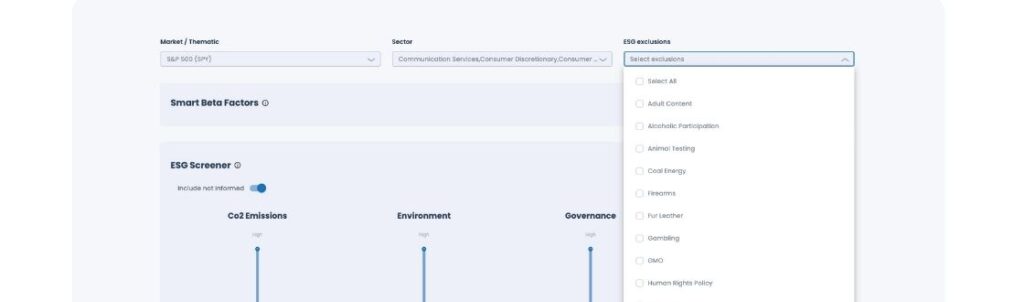

ESG Screener

ESG Filters: Our platform also offers ESG filters, allowing you to screen your portfolio for companies that meet specific ESG criteria. Our filters allow you to customize your screening criteria based on your specific ESG preferences, such as carbon emissions, diversity, and corporate governance.

ESG Ratings

ESG Ratings of Companies: Our platform provides ESG ratings of companies, giving you a snapshot of a company’s ESG performance. Our ratings are based on a comprehensive assessment of a company’s environmental, social, and governance practices, and are updated regularly to reflect any changes in a company’s ESG performance.

ESG investing is growing rapidly, driven by increasing recognition that ESG factors are essential to understanding a company’s long-term performance and risks. Investors are increasingly interested in ESG investing, and it can benefit both companies and investors. Our platform offers a range of ESG features that help investors make informed decisions about their portfolios, including ESG analytics, filters, and ratings. By using our platform, investors can ensure that their investments align with their values and contribute to a more sustainable future.