Tax rebalancing is an essential strategy used by investors to manage their tax liabilities while still maximizing their investment returns. This strategy involves adjusting your portfolio to maintain your desired asset allocation and reduce the tax burden associated with capital gains and losses.

What is Asset Allocation?

Asset allocation is the process of dividing your portfolio among different asset classes such as stocks, bonds, and cash. The aim of asset allocation is to achieve a balance between risk and return, where you can earn a return on your investment while minimizing the risk of losing your money. However, as the market fluctuates, your portfolio may drift away from your desired allocation, leading to unwanted tax consequences.

When an investor sells an investment that has appreciated in value, they are required to pay capital gains tax on the realized gain. Similarly, if an investor sells an investment at a loss, they can claim a capital loss to offset their taxable income. Tax rebalancing aims to minimize these capital gains and losses by buying and selling investments in a tax-efficient manner.

For example, let’s say an investor has a portfolio of $100,000, consisting of 60% stocks and 40% crypto. Over time, the stock market performs well, and the stock portion of the portfolio grows to $70,000, while the crypto portion decreases to $30,000. This shift in asset allocation may expose the investor to more risk than they are comfortable with. To rebalance the portfolio back to its original allocation, the investor may sell $10,000 worth of stocks and buy $10,000 worth of crypto.

However, selling the appreciated stocks would trigger a capital gains tax, which would eat into the investor’s returns. To minimize this tax liability, the investor may sell stocks that have not appreciated significantly or stocks that have decreased in value. By doing so, the investor can offset their realized gains with realized losses, reducing the overall tax liability.

In addition to reducing the tax liability associated with capital gains and losses, tax rebalancing can also help investors avoid the wash-sale rule. The wash-sale rule is a tax regulation that prohibits investors from claiming a capital loss if they buy the same or a substantially similar security within 30 days before or after selling the security at a loss. By rebalancing in a tax-efficient manner, investors can avoid triggering the wash-sale rule and maximize their tax benefits.

Tax Rebalancing Strategies

One of the most popular tax rebalancing strategies is the «asset location» strategy. Asset location involves placing different types of investments in different account types to maximize tax efficiency. For example, an investor may hold stocks that pay dividends in a tax-advantaged account such as an IRA, while holding bonds that pay interest in a taxable account. This strategy aims to minimize the tax liability associated with each type of investment, maximizing overall returns.

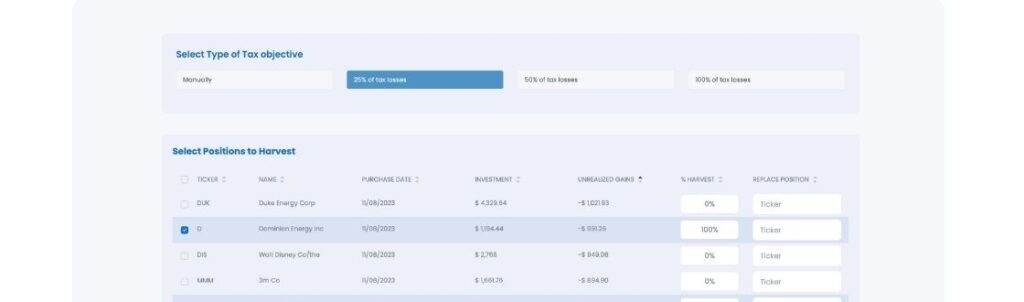

Another popular tax rebalancing strategy is the «tax-loss harvesting» strategy. Tax-loss harvesting involves selling investments that have decreased in value to offset realized gains and minimize tax liability. For example, if an investor holds a stock that has decreased in value, they may sell it to realize a capital loss. They can then use this loss to offset any realized gains in their portfolio, reducing their overall tax liability. This strategy can be particularly effective in years where there are significant market declines, as investors can harvest losses to offset gains in the future.

It is important to note that tax rebalancing should not be the sole driver of investment decisions. Investors should always prioritize their investment goals and risk tolerance over tax considerations. Additionally, tax laws can change, and investors should consult with a tax professional to ensure that their strategies are up to date and compliant with current regulations.

Tax rebalancing is a powerful strategy that can help investors manage their tax liabilities while still achieving their investment goals. By adjusting their portfolio to maintain their desired asset allocation.