Investment management has come a long way from the traditional methods of buying and holding stocks or bonds. With the advent of technology, there has been a surge in new investment strategies that have changed the way people think about managing their portfolios. One such strategy is direct indexing, which has gained significant popularity in recent years.

It’s important to consider the current economic conditions and the outlook for the stock market. In general, the stock market tends to do well when the economy is growing and corporate profits are rising. However, it’s also important to consider that the stock market can be highly volatile, and can fluctuate significantly in response to various events such as political or economic changes.

It’s also important to have a well-diversified portfolio, meaning to invest in different sectors, industries, and even countries, to reduce the risk of losing all your money if a specific sector or company has a downturn.

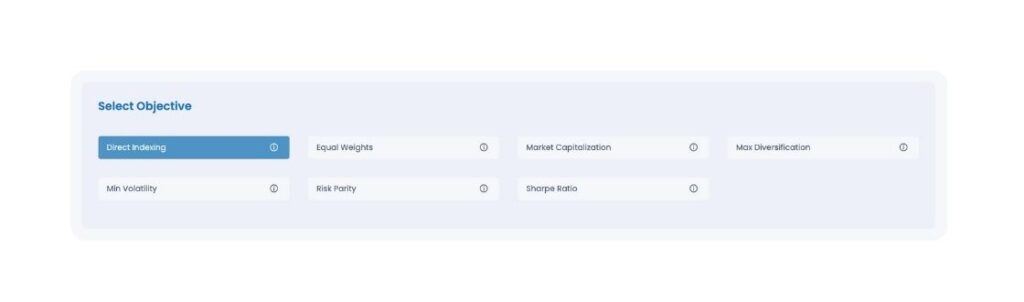

The process of direct indexing starts with the identification of an index, such as the S&P 500, that serves as a benchmark for the portfolio. The portfolio manager then selects individual stocks from this benchmark index that align with the investor’s investment goals and risk tolerance. The portfolio manager then buys and holds these individual stocks, managing them over time to ensure they continue to meet the investor’s goals and objectives.

Benefits of Direct Indexing

- Personalized Approach: Direct indexing offers a personalized approach to investing, allowing investors to tailor their portfolios to meet their specific investment goals.

- Tax Efficiency: One of the biggest benefits of direct indexing is the ability to minimize taxes. By holding individual stocks, investors can take advantage of tax-loss harvesting, which involves selling losing stocks to offset gains in other parts of their portfolios.

- Increased Control: Direct indexing gives investors more control over their portfolios by allowing them to make more precise investment decisions. This level of control can lead to better returns and a more robust portfolio.

- Lower Costs: Direct indexing can be less expensive than traditional investment management methods because it eliminates the need for a fund manager.

- ESG Investing: Direct indexing also provides investors with the ability to incorporate environmental, social, and governance (ESG) considerations into their portfolios. By investing in individual stocks, investors can select companies that align with their ESG values.

Drawbacks of Direct Indexing

- Higher Complexity: Direct indexing can be a complex process that requires a good understanding of the stock market and individual stocks. This can make it difficult for inexperienced investors to manage their portfolios effectively.

- Increased Risk: Investing in individual stocks carries more risk than investing in index funds or ETFs. This is because individual stocks are subject to a higher degree of market volatility.

- Increased Time Commitment: Direct indexing also requires a significant time commitment, as portfolio managers must continuously monitor and adjust their portfolios to meet their investment goals.

Direct indexing is a new and innovative approach to investment management that offers investors a personalized approach to investing. With its numerous benefits, including tax efficiency, increased control, and lower costs, it has become a popular choice for many investors. However, it is important to understand the risks and complexity involved with direct indexing and to carefully consider whether it is the right choice for your investment goals and risk tolerance.