Strategic Asset Allocation (SAA) and Tactical Asset Allocation (TAA) are two different investment strategies that can be combined to optimize a portfolio’s performance. These two strategies should always be aligned with our clients’ financial goals and risk profile to maximize the chances of success.

Strategic Asset Allocation is a long-term investment strategy that involves setting target allocations for various asset classes and periodically rebalancing the portfolio back to these targets as investment returns skew the original asset allocation percentages. The portfolio’s balance between equities, fixed income, and other asset classes is based on expected rates of return for each class.

On the other hand, Tactical Asset Allocation is a more active investment strategy that adjusts asset allocations to take advantage of market or economic conditions. This strategy requires a more hands-on approach as it involves short-term, tactical deviations from the strategic asset allocation to capitalize on unusual or exceptional investment opportunities. This strategy can be used in conjunction with strategic asset allocation, where the strategic asset allocation sets the baseline, and tactical asset allocation is used to make short-term deviations to capitalize on market conditions.

Here’s how you can combine these two strategies:

- Set a baseline with Strategic Asset Allocation: Start by determining your strategic asset allocation, which should be based on your client’s investment goals, risk tolerance, and investment horizon. This will serve as your baseline allocation.

- Use Tactical Asset Allocation for short-term adjustments: Once you have your baseline, you can use tactical asset allocation to make short-term adjustments to your client’s portfolio based on current market conditions. For example, if you believe that the technology sector will outperform in the next year, you might temporarily increase your client’s allocation to technology stocks.

- Rebalance Regularly: Regularly review and rebalance your client’s portfolio to ensure it stays aligned with your strategic asset allocation. This involves selling assets that have performed well and are now a larger portion of your portfolio than intended and buying assets that have underperformed and are now a smaller portion of your portfolio.

- Monitor Market Conditions: Keep a close eye on market conditions and economic indicators. These can provide valuable insights into potential investment opportunities and risks.

- Review and Adjust: Review your strategic asset allocation periodically to ensure it still aligns with your client’s investment goals and risk tolerance. Adjust your strategic asset allocation and tactical asset allocation strategies as needed.

Remember, combining strategic and tactical asset allocation requires a good understanding of financial markets and investment principles. It’s important to carefully consider your client’s risk tolerance and investment goals before implementing this strategy.

In this article, we will focus on Step 1. We will use an example of how we can combine strategic and tactical asset allocation with financial planning to provide solid advisory. We will describe through a real example how all these pieces can work together using CITEC’s technology.

Step 1: Set a baseline with Strategic Asset Allocation

Financial Objectives

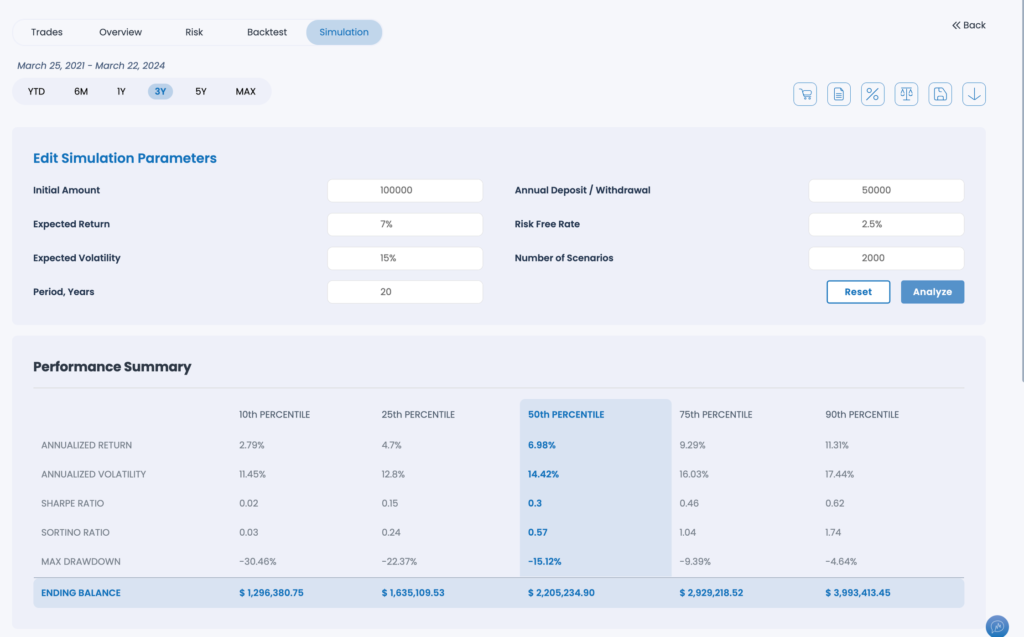

Our client is 45 years old and wants to set aside some money to start preparing for retirement. He has currently set aside approximately $100,000 and is committed to saving $50,000 a year for this purpose. He plans to retire in around 20 years, and we have estimated that with approximately $2.0 million, he could retire comfortably (spending $120,000 a year for the next 20 years).

Plan for Saving Period

Our client is planning to retire in 20 years, and we believe a Growth Asset Allocation Strategy would help him achieve his investment goals while having risk under control.

Assuming a:

- $100k initial investment

- $50k annual contribution

- 7% average return

- ~15% volatility

Our client will save between ~$1.3M and $4.0M at 80% confidence level with an expect of $2.2M.

Exhibit 1: Simulation Saving Phase (using CITEC)

CITEC’s Simulator

Strategic Asset Allocation for Saving Period

We can build our own strategies or use predefined strategies. For instance, in CITEC’s Marketplace you can access predefined strategies and then customize them to your clients’ specific needs, saving a lot value time and enhancing the conversation with your client.

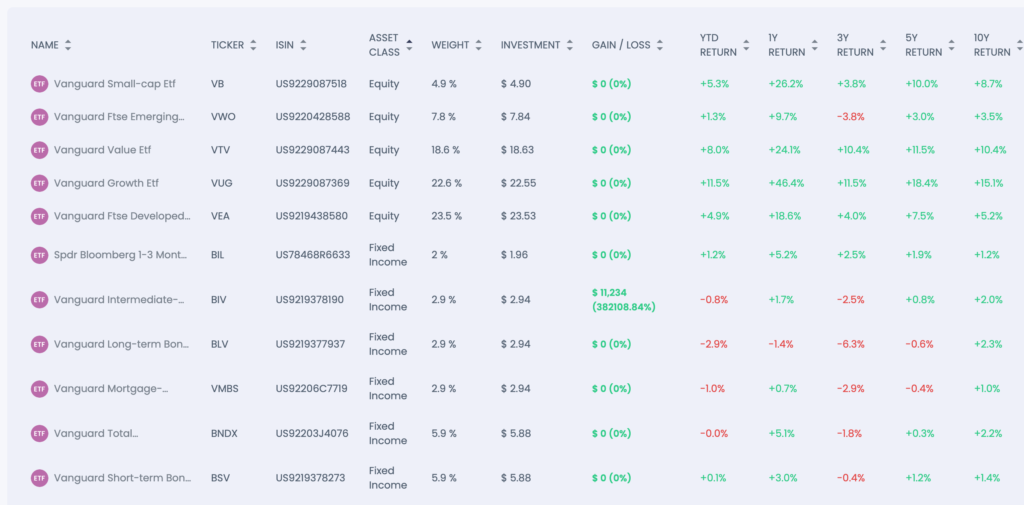

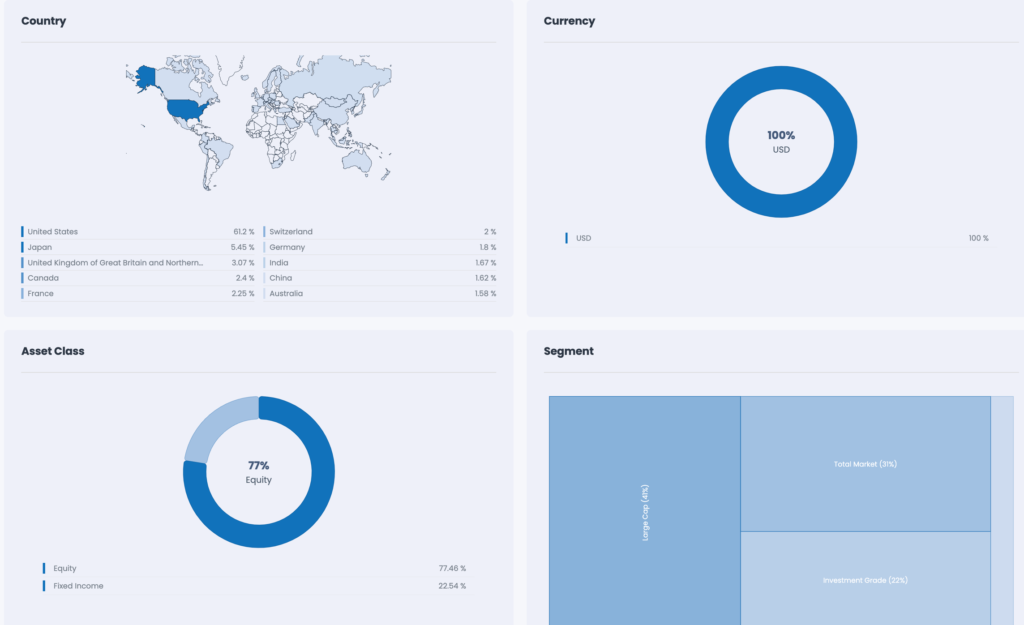

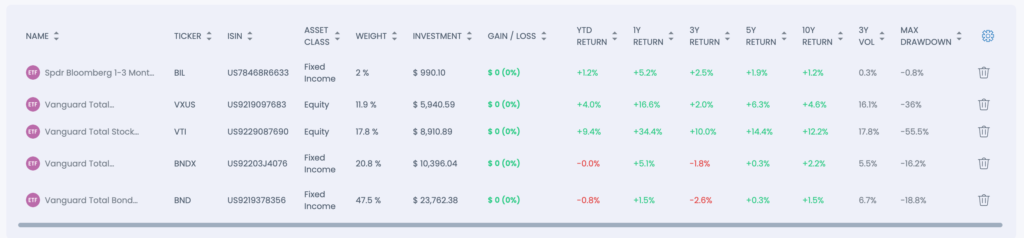

Let’s start by using the Vanguard CRSP Asset Allocation Strategy designed for a growth-oriented client. This portfolio consists of 77% Equity and 23% Fixed Income, providing exposure to international markets as displayed below (Exhibit 2 to 5).

The portfolio allocates 61% to the US and the remaining percentage to international markets, encompassing both developed and emerging markets. Notably, there are tactical allocations evident in Japan and the UK, with 5.5% and 3.1% respectively.

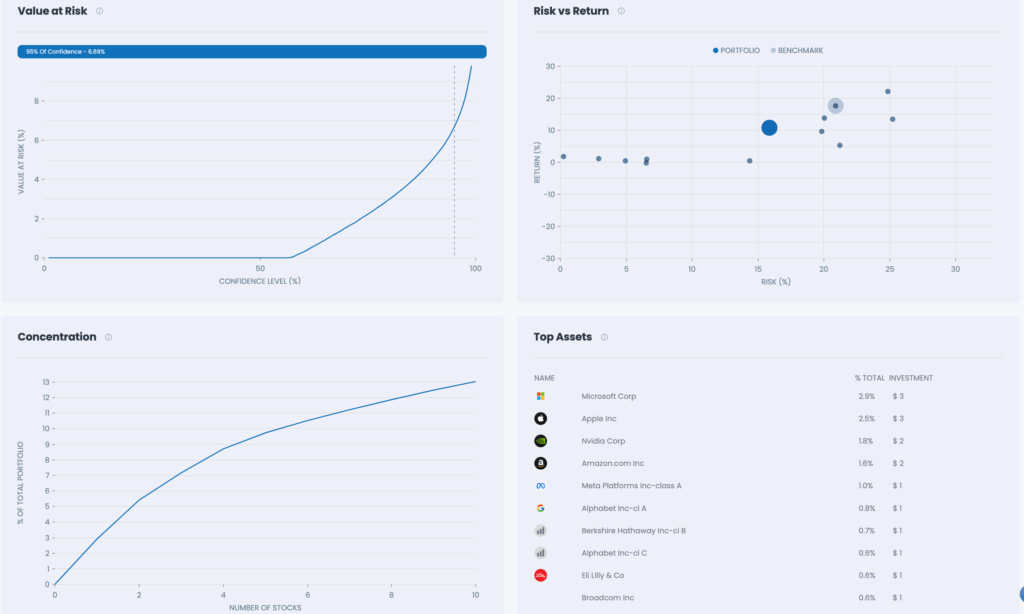

In terms of risk management, the portfolio exhibits a monthly value at risk of 6.5% (at 95% confidence level) and a 5-year volatility of 15.89%, aligning with the stated objectives. Moreover, the top 10 underlying positions collectively represent less than 13% of the portfolio, underscoring its high level of diversification.

Over the past 5 years, this portfolio has delivered an impressive 56% return (~9.1% annualized). To provide a visual representation of this performance, you can refer to CITEC’s backtest. Additionally, we can consider making tactical adjustments based on the prevailing market conditions.

With we can access a wide range of strategies all in one place, being able to do a complete look-through in just a matter of seconds to pick the best option for your client. We will start with Vanguard CRSP Asset Allocation Strategy for a growth client. This portfolio is 77% Equity and 23% Fixed income and gives exposure to international markets as shown in the tool.

The portfolio allocates 61% to the US and the rest to international markets, including both developed markets as well as emerging market. We can see a tactical bet in Japan and UK with 5.5% and 3.1% respectively.

The portfolio has a monthly value at risk of 6.5% (at 95%) and a 5Yr volatility of 15.89% in line with the objective. Top 10 underlying positions represent less than 13% of the portfolio, highlighting the level of diversification.

This portfolio would have had a 56% return in the last 5 years (~9.1% annualized). To help you visualize this, you can see this in CITEC’s backtest. We could make some tactical bets depending on the market environment.

Exhibit 2: Growth Strategic Asset Allocation Strategy – Positions (using CITEC)

CITEC’s Positions Analysis

Exhibit 3: Growth Strategic Asset Allocation Strategy – Overview (using CITEC)

CITEC’s Overview Analysis

Exhibit 4: Growth Strategic Asset Allocation Strategy – Risk (using CITEC)

CITEC’s Risk Analysis

Exhibit 5: Growth Strategic Asset Allocation Strategy – Backtesting (using CITEC)

CITEC’s Backtest Analysis

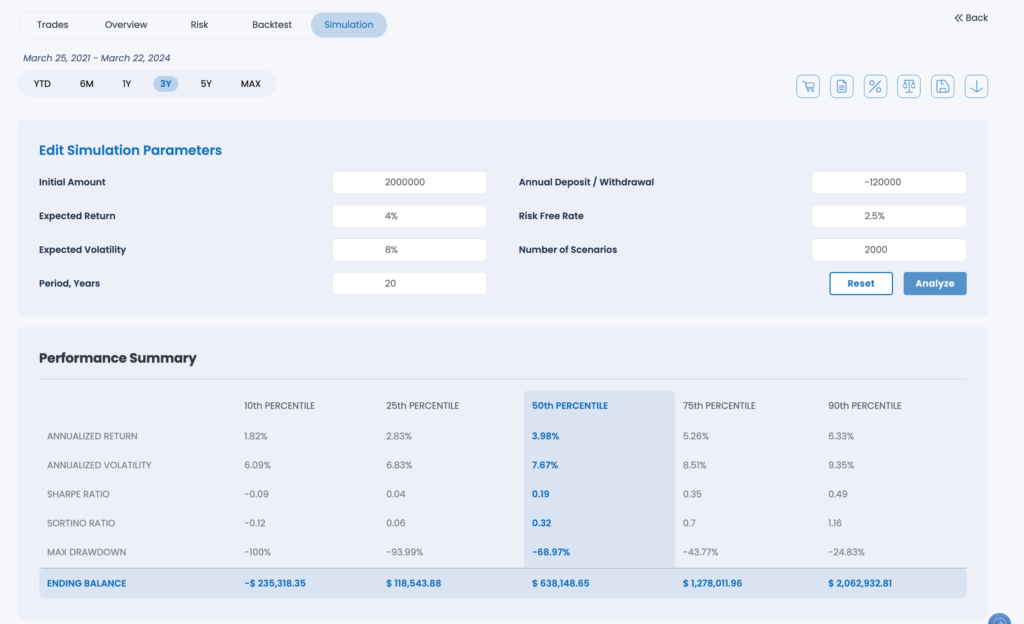

Plan for Retirement Period

As the client transitions into retirement, the focus shifts towards preserving capital and generating sustainable income streams. With a conservative portfolio expected to deliver a 4% return and exhibiting lower volatility at 8%, the client can comfortably sustain an annual expenditure of $120,000 over the next two decades. This allocation allows for a withdrawal rate that more than doubles the annual contribution during the saving phase while maintaining a prudent risk profile. By meticulously planning for the retirement period, the client can enjoy financial security and peace of mind throughout their golden years.

CITEC’s Simulator

Exhibit 6: Simulation Retirement Phase (using CITEC)

CITEC’s Positions Analysis

Conclusion

In conclusion, the synergy between strategic and tactical asset allocation, coupled with comprehensive financial planning, forms the cornerstone of sound investment advisory. By incorporating CITEC into the decision-making process, advisors can leverage sophisticated algorithms to analyze market data, identify opportunities, and mitigate risks effectively. This not only enhances the transparency of investment strategies but also fosters deeper client engagement and trust. As advisors navigate the complexities of today’s financial landscape, it is imperative to embrace innovative solutions like CITEC to deliver personalized, goal-oriented investment strategies that align with clients’ aspirations. By marrying technology with expertise, advisors can empower clients to navigate their financial journey with confidence and achieve lasting prosperity.

Through the seamless integration of strategic and tactical asset allocation with cutting-edge technology like CITEC, advisors can elevate the client experience, drive superior outcomes, and forge enduring relationships built on trust and mutual success.

Sources:

Moneywise – Thrivent – SmartAsset – Schroders – Vanguard