In the ever-evolving landscape of wealth and asset management, offering clients a simple yet effective way to achieve global exposure is key. For those seeking to streamline their investment strategy, Asset Allocation ETFs present a compelling solution.

What is an Asset Allocation ETF?

An Asset Allocation ETF, or Exchange-Traded Fund, is designed to provide a diversified mix of assets, such as stocks and bonds, aligned with a specific risk level or investment goal. These ETFs adjust their asset mix based on the investor’s risk tolerance—allocating more bonds for conservative profiles and more stocks for aggressive ones. Automatic rebalancing ensures the fund maintains its target allocation, providing a cost-effective way to achieve diversification without the need for individual stock picking.

Why Consider Asset Allocation ETFs?

Asset Allocation ETFs offer several benefits, making them an attractive choice for both new and seasoned investors:

• Cost-Effective Diversification: These ETFs provide broad market exposure, covering over 2,000 companies and governments, at a fraction of the cost. With a low Total Expense Ratio (TER) and minimal initial investment, they serve as an accessible entry point for investors.

• Automatic Rebalancing: Semi-annually rebalancing ensures that portfolios remain aligned with market conditions, reducing the need for constant oversight and allowing investors to maintain their desired risk level.

Pros and Limitations

Pros:

• Affordable and diversified, offering broad exposure to multiple asset classes.

• Easy to implement with low starting capital, making them suitable for a wide range of investors.

Limitations:

• Limited customization options, making it challenging to exclude specific sectors.

• Reduced flexibility for tactical market adjustments, particularly in response to market shifts.

• Limited opportunities for tax-loss harvesting.

How Advisors Can Use Asset Allocation ETFs

Wealth and asset managers can integrate Asset Allocation ETFs into their clients’ portfolios in several ways:

• Portfolio Foundation: These ETFs can serve as a stable base, helping to manage risk while providing consistent exposure across various asset classes.

• Client Introduction: Ideal for clients new to investing, these ETFs allow them to start small before moving on to more tailored investment solutions.

Spotlight on iShares Allocation ETFs

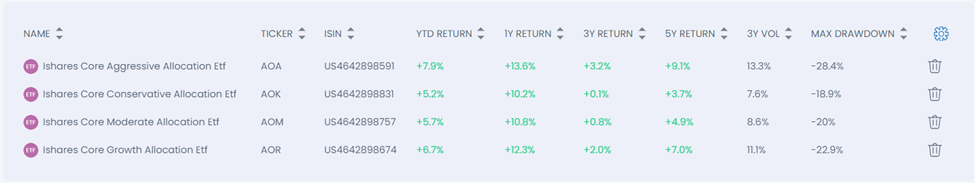

For those interested in Asset Allocation ETFs, iShares offers a range of options tailored to different risk profiles:

• iShares Core Conservative Allocation ETF (AOK): +3.7% 5Y annualized return

• iShares Core Moderate Allocation ETF (AOM): +4.9% 5Y annualized return

• iShares Core Growth Allocation ETF (AOR): +7.0% 5Y annualized return

• iShares Core Aggressive Allocation ETF (AOA): +9.1% 5Y annualized return

Exhibit 1: ETF’s Performance Information

These ETFs, managed by iShares under BlackRock’s expertise, share a competitive TER of 0.15%. They are structured to match different risk profiles while providing a reliable, diversified, and globally recognized investment option for your clients.

Analysis of iShares Allocation ETFs Using Citec AI Platform

For a more in-depth understanding of these ETFs, we utilized the Citec platform to evaluate their suitability for various investor profiles.

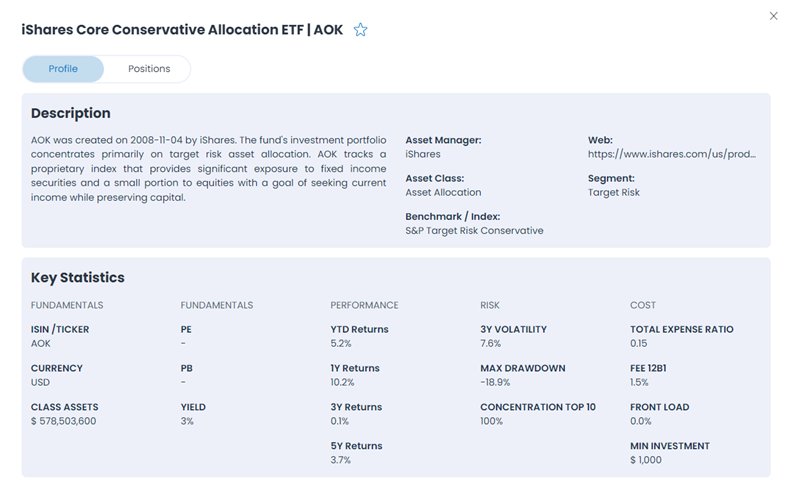

ETF Overview:

• All four ETFs were launched on November 4, 2008, making them comparable in terms of maturity and performance history.

• The risk profiles range from conservative (AOK) to aggressive (AOA), with corresponding allocations to fixed income and equities. AOK focuses on capital preservation with a heavier allocation to bonds, while AOA seeks long-term appreciation through a higher allocation to equities.

Key Statistics:

• Basic Information: Each ETF has a ticker symbol, trades in USD, and manages assets exceeding $500 million.

• Performance: The 5-year annualized returns highlight the aggressive strategy (AOA) as the highest performer, followed by growth (AOR), moderate (AOM), and conservative (AOK).

• Risk: The conservative ETF (AOK) exhibits the lowest volatility and maximum drawdown, indicating a lower risk profile compared to its more aggressive counterparts.

Exhibit 2: ETF’s Overview Example

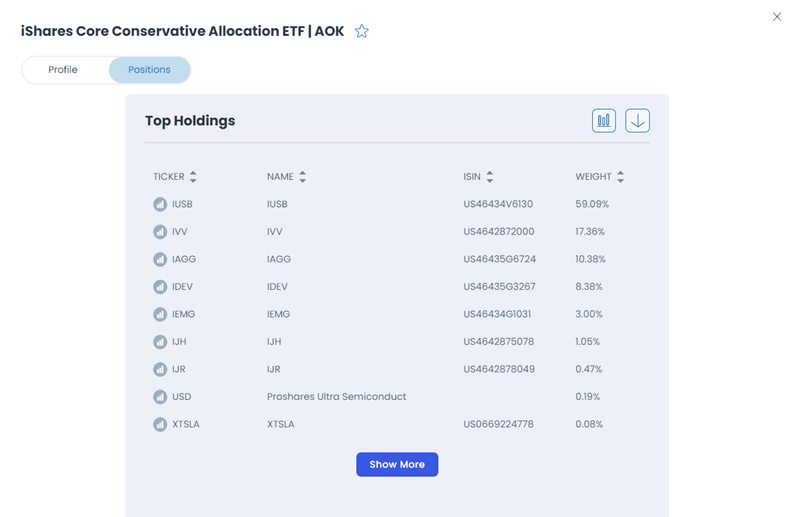

Portfolio Composition

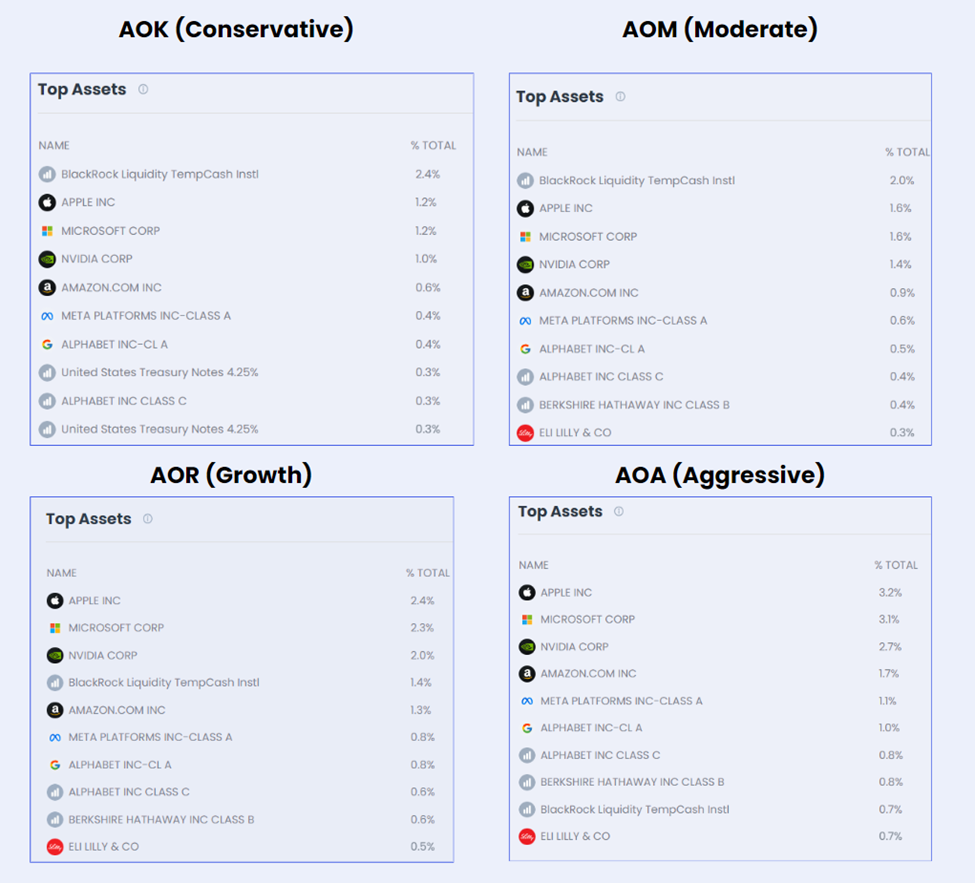

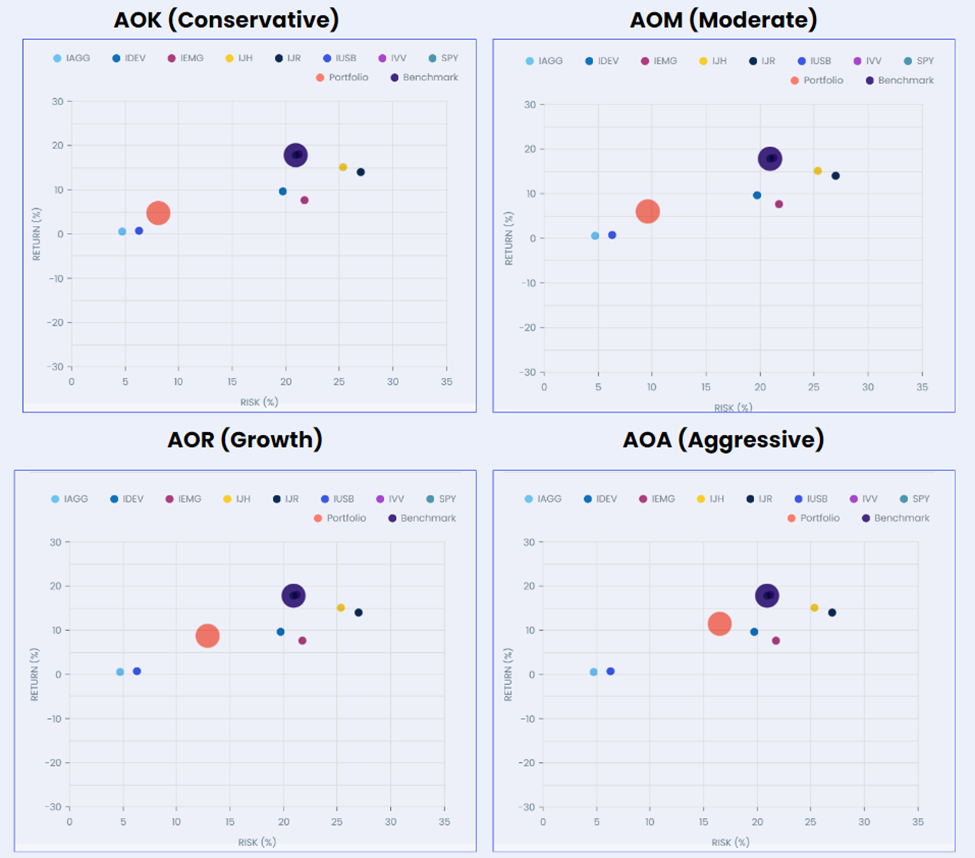

A detailed look at the main positions within each ETF reveals their asset allocation:

| Positions | AOK (Conservative) | AOM (Moderate) | AOR (Growth) | AOA (Aggressive) |

| IUSB (CORE TOTAL USD BOND MARKET): Fixed Income | 59,09% | 50,04% | 33,61% | 16,76% |

| IVV (CORE S&P 500 ETF): Equities | 17,36% | 23,26% | 34,57% | 45,98% |

| IAGG (Core Intl Aggregate Bnd ET): Fixed Income | 10,38% | 8,86% | 5,91% | 2,94% |

| IDEV (CORE MSCI INT DEVEL ETF): Equities | 8,38% | 11,30% | 16,69% | 22,19% |

| IEMG (CORE MSCI EMERGING MARKETS): Equities | 3,00% | 4,00% | 5,97% | 7,94% |

| IJH (CORE S&P MID-CAP ETF): Equities | 1,05% | 1,41% | 2,08% | 2,77% |

| IJR (CORE S&P SMALL-CAP ETF): Equities | 0,47% | 0,64% | 0,94% | 1,25% |

Also, we can observe the exposure that each ETF has towards different countries and economic sector:

| ETF | Sector 1 | Sector 2 | Sector 3 | Country 1 | Country 2 | Country 3 |

| AOK | IT (7.01%) | Financials (4.48%) | Industrials (3.44%) | US (73.28%) | Japan (2.22%) | UK (1.4%) |

| AOM | IT (9.38%) | Financials (6.01%) | Industrials (4.62%) | US (71.38%) | Japan (2.81%) | UK (1.78%) |

| AOR | IT (13.95%) | Financials (8.92%) | Industrials (6.85%) | US (67.83%) | Japan (3.98%) | UK (2.51%) |

| AOA | IT (18.54%) | Financials (11.85%) | Industrials (9.11%) | US (64.23%) | Japan (4.99%) | UK (3.24%) |

Another notable observation is the asset composition of the different ETFs. As shown in Exhibit 3, the Conservative and Moderate options have a money market instrument issued by BlackRock as their primary holding. Additionally, these two ETFs are the only ones with significant positions in Fixed Income, such as U.S. Treasury Notes. In contrast, the top holdings in the Growth and Aggressive ETFs are predominantly mega-cap companies in the IT sector.

Exhibit 3: Top Assets by ETF

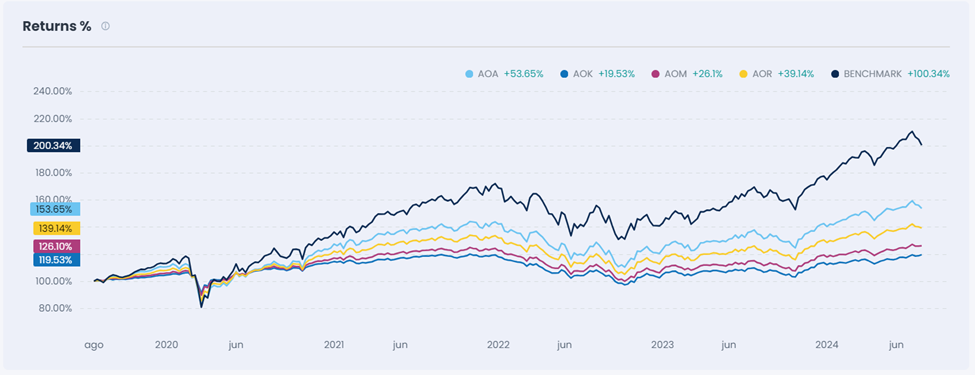

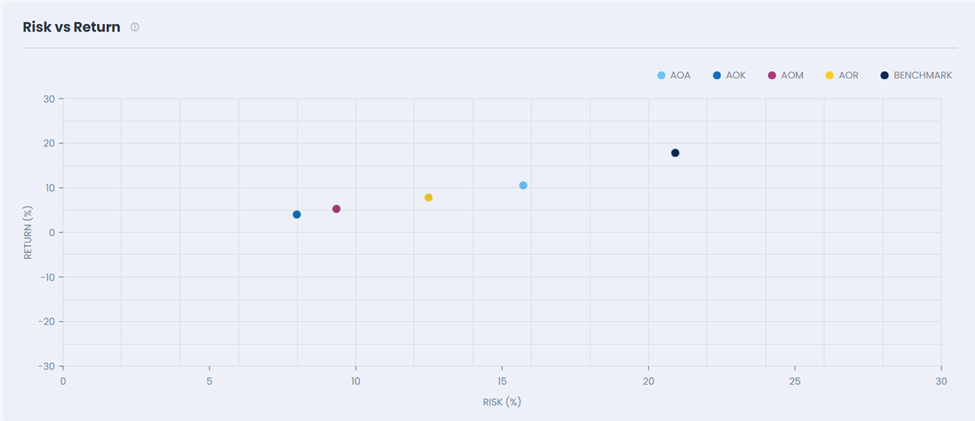

Performance Analysis

During the pandemic, these ETFs demonstrated resilience, outperforming their benchmarks. However, they have not matched the significant gains of the S&P 500, which doubled in value over the past five years. As of now, the S&P 500 is experiencing a downturn due to bearish market sentiment, driven by factors such as the sharp drop in the Yen, poor performance of Japanese stocks, and disappointing Q2 2024 corporate earnings. Additionally, macroeconomic uncertainties, including worse than expected U.S. employment data and potential interest rate cuts by the Fed, may lead to larger corrections in higher-risk funds if a bearish market emerges in the last quarter of the year.

Exhibit 4: Risk vs Return Analysis (5 years annualized returns)

Exhibit 5: Risk vs Return Analysis (5 years annualized returns) by ETF

Conclusion: Choosing the Right ETF for Your Risk Profile

The relationship between risk and return remains appropriate, with no apparent arbitrage opportunities. For investors, the choice should involve taking on more risk only if it leads to proportionately higher returns. Based on our analysis, the best choices within each risk category are:

• In the Conservative Group: AOK (Conservative) ETF, recommended for the most risk-averse investors.

• In the Aggressive Group: AOR (Growth) ETF, ideal for those willing to accept more risk for potentially higher returns.

Ultimately, the decision between these ETFs should align with your or your client’s risk tolerance and investment goals. Whether opting for a conservative approach with AOK or pursuing growth with AOR, these iShares ETFs provide a diversified and efficient way to manage portfolios in today’s dynamic market environment.

We used CITEC AI platform to select, compare, analyze, and backtesting potential strategies.