In today’s rapidly evolving technological landscape, one theme stands out among investors seeking long-term growth potential: artificial intelligence, automation, and robotics. This convergence of cutting-edge technologies is reshaping industries, revolutionizing processes, and creating unprecedented opportunities for investors keen on capturing the future. From autonomous vehicles to machine learning algorithms, the impact of AI-driven innovations is felt across sectors, promising enhanced efficiency, productivity, and profitability.

Investing in the theme of artificial intelligence, automation, and robotics entails not only recognizing its transformative potential but also understanding the avenues through which one can effectively participate in this trend. In this article, we delve into the various investment vehicles available to investors looking to capitalize on this theme. From ETFs to Mutual Funds and individual stocks, each offers unique exposure to the burgeoning field of AI and automation.

Furthermore, we explore the underlying companies within these investment vehicles, examining how they are at the forefront of harnessing AI technologies to drive growth and innovation. Whether it’s companies specializing in robotics, data analytics, or autonomous systems, understanding their positioning within the AI landscape provides valuable insights into their potential for long-term success.

Join us as we navigate through the intricacies of investing in artificial intelligence, automation, and robotics. Using CITEC’s platform, we will evaluate different investment vehicles and the underlying companies they encompass. To provide investors with the knowledge and tools necessary to capitalize on this transformative trend and unlock the potential for substantial returns in the years to come.

Selecting best ETFs and Mutual Funds Specialized AI

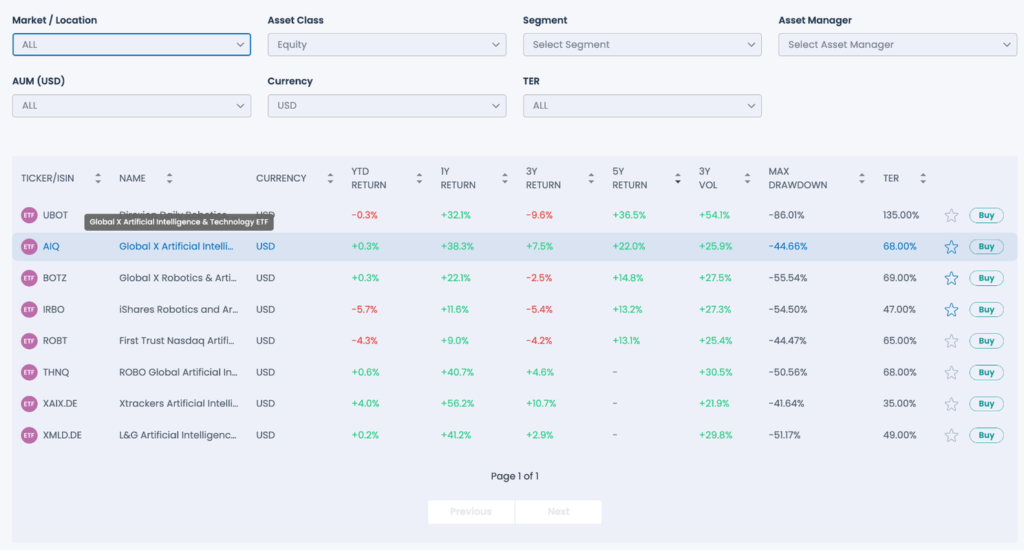

List of ETFs investing in the theme

The lack of consistency or high correlations among ETFs investing in the theme suggests a lack of uniformity in defining the universe of vehicles that could benefit from this trend. However, it’s noteworthy that most of these ETFs have delivered impressive performances over the past year, with returns exceeding 40%.

Among them, the Xtrackers Artificial Intelligence ETF stands out for its remarkable performance over the last year and its consistent track record over the past three years. Conversely, the iShares Robotics and Artificial Intelligence ETF faced challenges, as it generated negative returns during this period.

CITEC’s ETF Screener

Worst Performer (IRBO – iShares Robotics and Artificial Intelligence Multisector ETF)

Was created on 2018-06-26 by iShares. The fund’s investment portfolio concentrates primarily on theme equity. The ETF currently has 578.06m in AUM and 112 holdings. IRBO tracks an equal-weighted index of global equities involved in robotics and artificial intelligence.

CITEC’s Asset Analysis

Best performer (Global X Robotics & Artificial Intelligence ETF)

Was created on 2019-01-29 by Xtrackers. The fund’s investment portfolio concentrates primarily on theme equity. The ETF currently has 1809.68m in AUM and 82 holdings. The investment objective and policies for each Fund will be formulated by the Directors at the time of the creation of that Fund.

CITEC’s Asset Analysis

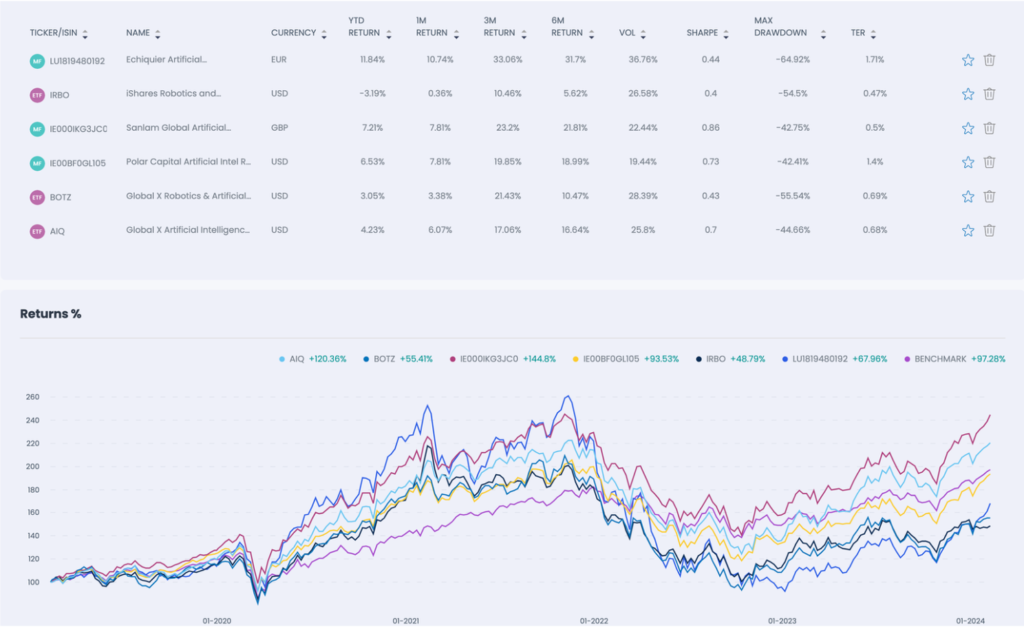

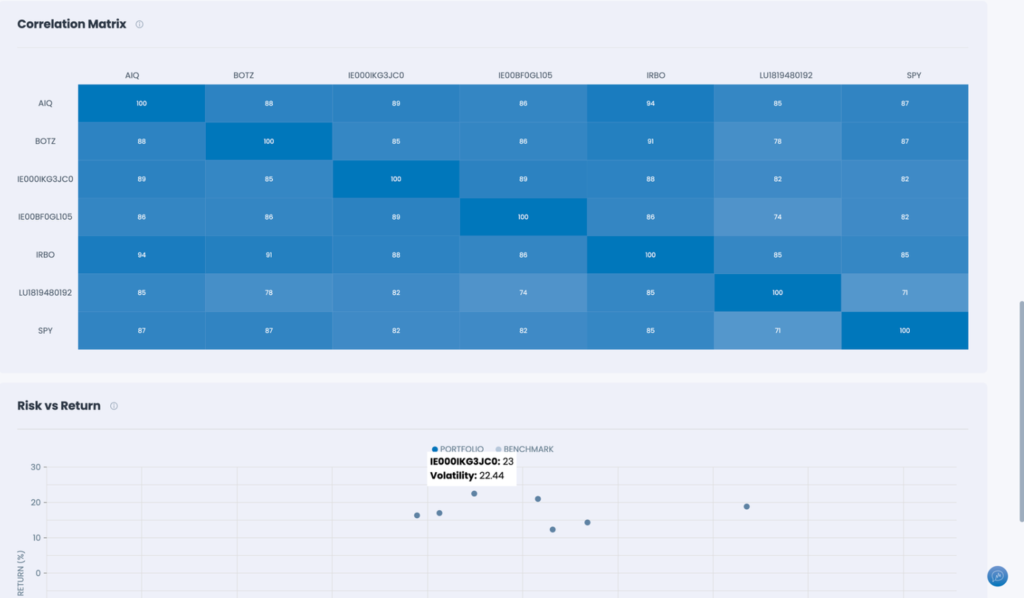

Running a Comparison

Performance

- Best Performer: IE000IKG3JC0 | Sanlam Global Artificial Intelligence I GBP Acc.

- Best Sharpe: IE000IKG3JC0 | Salam Global Artificial Intelligence has also the highest risk vs. return performance.

CITEC’s Comparison Analysis

CITEC’s Comparison Analysis

Deep Dive on the Mutual Fund with the best Performance

Description

Sanlam Global Artificial Intelligence Fund (Class I) is a fund that aims to achieve capital appreciation by primarily investing in equity and equity-related securities. These securities are issued by companies that are engaged in the main activities associated with artificial intelligence, whether by way of research and development, in the provision of services, or in the transformational adoption of such services[^1^].

Sources: [^1^]: HL.co.uk [^2^]: Sanlam.co.uk

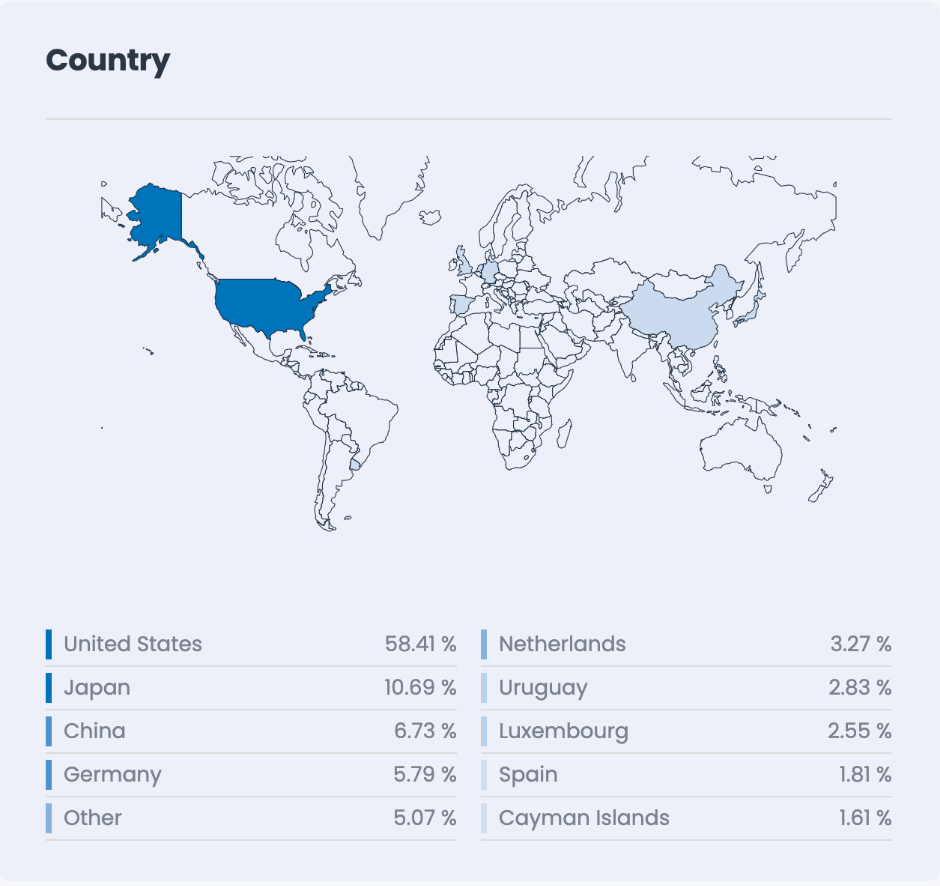

CITEC’s Geography Analysis

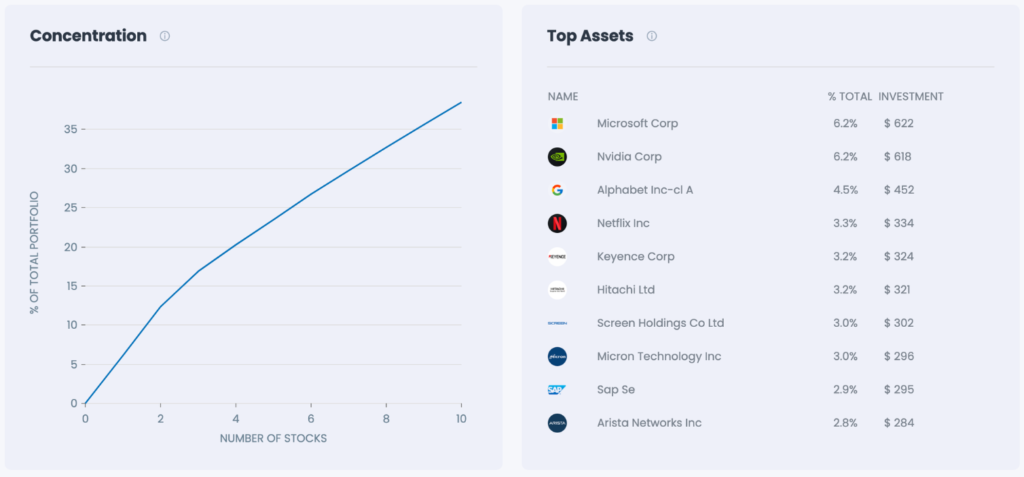

CITEC’s Asset Analysis

Fund Managers

Chris Ford and Tim Day are the fund managers of the Sanlam Global Artificial Intelligence Fund. They both have a rich history in the field of asset management.

Tim Day:

Before joining Sanlam in January 2021, Tim Day worked at Smith & Williamson Investment Management LLP. He joined the firm in May 2015 to manage the Smith & Williamson North American Equity Fund and Smith & Williamson Mid Ocean World Investment Fund. He was hired alongside Chris Ford to run a global equity and a U.S. equity fund (source).

Both Chris Ford and Tim Day started managing the Sanlam Global Artificial Intelligence Fund on 29th July 2022. They have been instrumental in the fund’s performance and growth, leveraging their expertise in AI and investment management.

Please note that there might be other individuals named Chris Ford and Tim Day in different fields, so it’s important to specify the context when searching for information about them. For instance, there is a Chris Ford who was an American professional basketball player and head coach in the NBA (source).

For more detailed information about their professional backgrounds and achievements, I would recommend reaching out to Sanlam directly or checking their official website and other reliable financial news sources.

Chris Ford:

Unfortunately, there isn’t much detailed information available about Chris Ford’s professional background. However, he is known for his work as a fund manager at Sanlam, where he manages the Global Artificial Intelligence Fund. He has been featured in various media and investor events, providing overviews of the Fund’s performance since its inception and sharing his insights on the future of AI (source).

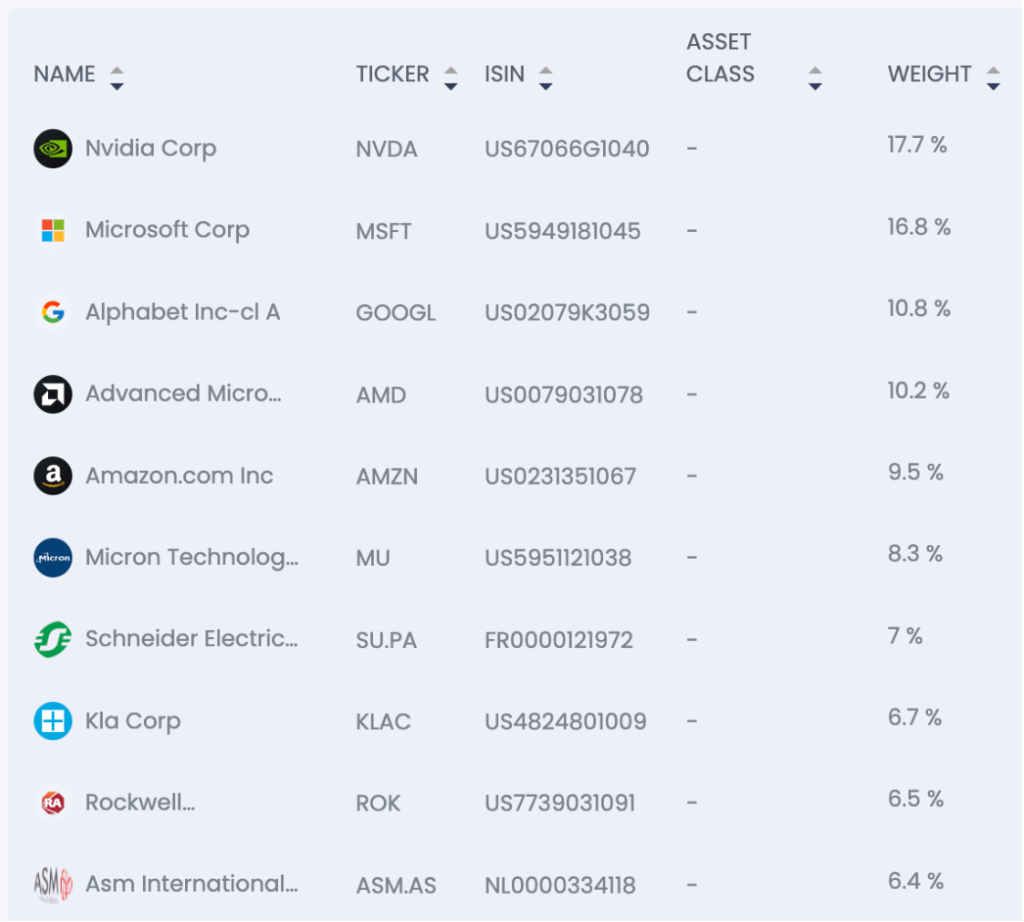

Direct Investing

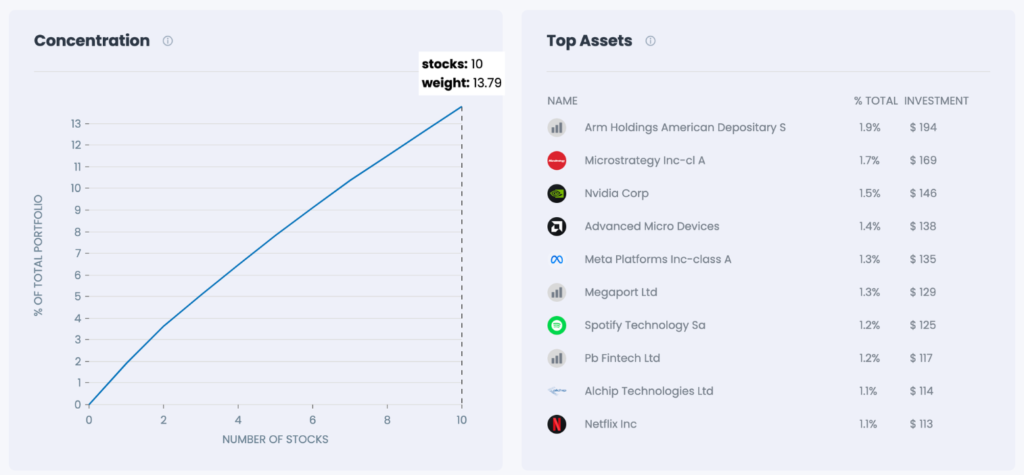

Most funds investing in AI have a large portion assign to Large Tech companies such as NVIDIA, Microsoft, etc. In this case we are going to create a portfolio that invest 50% of the capital directly into this companies and the rest in an equal weight ETF. By doing this we would be able to capitalize on the opportunity with a lower cost and more flexibility to operate.

Top Companies

CITEC’s Top Assets Analytics

How CITEC Helps Advisors Reach These Conclusions

At CITEC, we’re committed to providing advisors with the tools they need to make informed investment decisions. In crafting this article, we utilized CITEC’s Comparison tool, Screener tool, and Analytics tool to meticulously analyze various investment options within the realm of artificial intelligence, automation, and robotics. Through comprehensive comparisons, in-depth screening, and insightful analytics, we arrived at the conclusions presented here. Our aim is to empower advisors with the knowledge and resources necessary to navigate the ever-changing landscape of investment opportunities confidently. With CITEC’s suite of tools at their disposal, advisors can unlock new insights, identify promising opportunities, and ultimately, help their clients achieve their investment goals.

To know more about CITEC, schedule a live demo with our team o visit our website.