In today’s fast-pace financial reality, wealth management firms grapple with the complexity of research processes. The advent of big data and the proliferation of analytics tools have presented both opportunities and challenges. While these technologies enable research teams to delve deep into market trends and investment opportunities, the subsequent communication of these insights to financial advisors remains a bottleneck.

The multifaceted nature of financial data, coupled with the use of diverse platforms, leads to information silos. Research teams may utilize one platform for market analysis, another for portfolio management, and yet another for risk assessment. This fragmentation poses a considerable challenge when trying to create a cohesive narrative for financial advisors who must navigate disparate sources to get a holistic understanding of the market landscape.

The Current Landscape: A Web of Challenges

As we’ve engaged in over 300 meetings with more than 200 clients at CITEC, a pervasive challenge has surfaced – the critical issue of research getting lost in transition. Visualize this scenario: Companies, armed with a multitude of platforms, engage in the intricate dance of financial research. Yet, communication falters as advisors receive only fragmented insights, often delivered through the cumbersome channels of complex Excel sheets or scattered Drive folders.

This communication breakdown not only hinders the effectiveness of financial advisors but also impacts client satisfaction. In an industry where timely and accurate information is paramount, finding solutions to enhance communication between research teams and advisors becomes imperative.

Pain Points Plaguing the Industry

1. Data Disarray: Research, scattered across diverse platforms, creates a tapestry of disjointed information, making it a formidable challenge for advisors to weave a comprehensive and coherent narrative.

2. Communication Blackout: Advisors find themselves in the dark as a lack of a technological bridge obstructs the smooth flow of insights gained in strategic meetings with Asset Managers and different houses.

3. Incomplete Information Flow: The advisor’s toolkit often comprises only half the puzzle, hindering their ability to make informed decisions. Complex Excel sheets and scattered Drive folders contribute to a fragmented information flow, impeding the holistic understanding of market dynamics.

Evolution of Research Processes: Shaping Tomorrow’s Landscape

In response to these challenges, the Wealth Management and financial advisory sector is undergoing a transformative evolution, forging new pathways to enhance the efficiency and effectiveness of research processes:

1. Centralized Collaboration Hubs: Recognizing the need for cohesion, industry leaders are gravitating towards centralized platforms. At the forefront of this shift is CITEC, offering a unified hub where research is conducted, stored, and seamlessly communicated. This centralized approach eliminates the chaos of data silos, offering a panoramic view of research findings to advisors.

2. Real-Time Connectivity: The era of delayed insights is fading. Innovative tools are now facilitating real-time connectivity, ensuring advisors receive immediate access to insights gained from meetings and research. This shift accelerates the decision-making process, allowing advisors to respond promptly to market changes.

3. Holistic Data Integration: Modern technologies allow for the integration of diverse datasets into a centralized system. CITEC’s commitment to comprehensive data integration ensures that advisors receive not just fragmented pieces but a cohesive and detailed mosaic of research findings.

4. Enhanced Communication Channels: Evolving platforms prioritize seamless communication between research teams and advisors, bridging the gap that once hindered effective information flow. This emphasis on communication ensures that insights from various stakeholders, including Asset Managers, are delivered seamlessly to the advisors.

CITEC’s Game-Changing Role: Shaping the Future of Financial Insight

Enter CITEC, an industry disruptor that’s not just addressing these challenges but reshaping the future of financial insight. The Research Tools provided by CITEC not only streamline the research process but also foster a collaborative environment, ensuring that insights gained are not lost in transition.

1. Unified Knowledge Repository: CITEC establishes a centralized knowledge repository, eliminating data silos and providing advisors with a comprehensive view of market trends. The chaos of fragmented data is replaced with a harmonious repository that aids in better decision-making.

2. Real-time Collaboration: The tools enable real-time collaboration, allowing professionals to share insights, exchange ideas, and collectively contribute to a more comprehensive research process. This collaborative spirit ensures that advisors receive not just a piece of the puzzle but the entire picture.

3. Cutting-edge Analytics: CITEC integrates AI and advanced analytics, empowering financial advisors with unparalleled data analysis capabilities for more informed decision-making. This advanced analytical prowess enables advisors to extract meaningful insights from the vast sea of data, propelling them towards smarter and more strategic decisions.

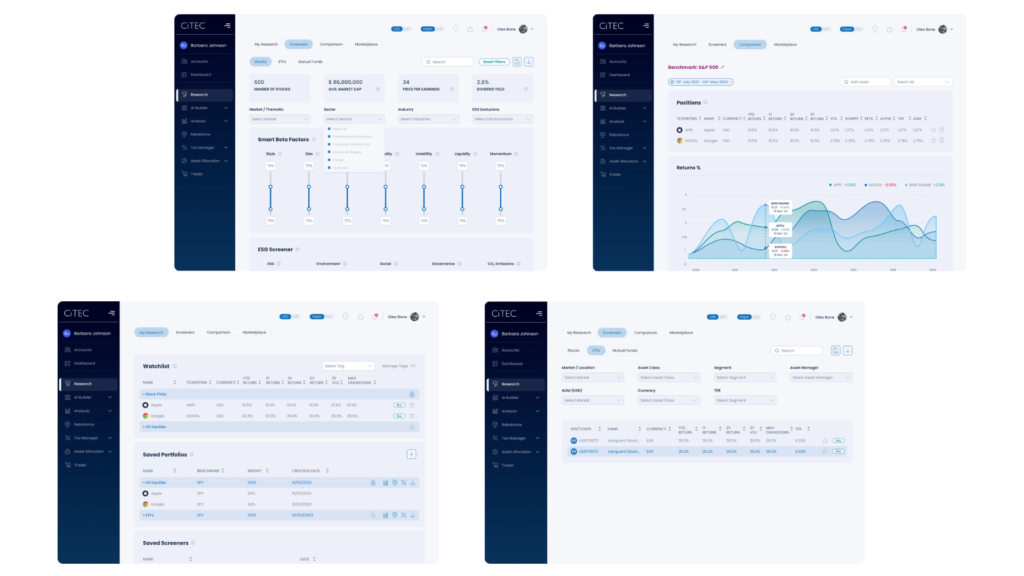

CITEC’s Research Module

Embracing the Evolution: A Call to Industry Professionals

The evolving landscape of Wealth Management research is not a solitary journey but a collective endeavor of industry professionals. By acknowledging and addressing current challenges, the industry is sculpting an era of cohesion, collaboration, and efficiency. CITEC, standing tall at the forefront of this evolution, invites industry professionals to embrace innovation, enhance collaboration, and navigate the ever-evolving financial landscape with newfound confidence.