Smart Beta investment strategies have emerged as a powerful tool for financial advisors seeking to enhance their clients’ portfolios through a systematic, rules-based approach. Unlike traditional fund managers who analyze individual companies, Smart Beta strategies focus on creating stock or bond portfolios that emphasize specific fundamental factors. The goal is to outperform the market by predicting the performance of companies based on these factors. This guide, tailored for financial advisors, offers an in-depth understanding of Smart Beta strategies and how to effectively apply them in wealth management.

Key Smart Beta Factors

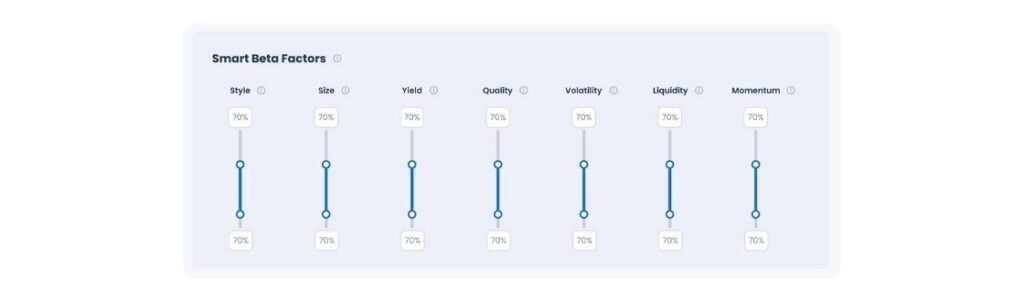

Smart Beta strategies center around various factors that influence investment performance. The most popular factors include:

1. Size: This factor involves investing in companies based on their market capitalization, calculated as the total dollar market value of a company’s outstanding stock shares. Size plays a pivotal role in determining the composition of a Smart Beta portfolio.

2. Dividend: Smart Beta portfolios may prioritize companies based on the dividend yield ratio, which measures dividends paid to investors in relation to the company’s market capitalization. Dividend-focused strategies are often a cornerstone of Smart Beta.

3. Style (Value vs. Growth): Another key factor revolves around investing in companies based on price-to-earnings ratios (P/E). It’s important to note that earnings can be measured in various ways, such as expected future earnings versus current earnings. Determining the right style factor is a crucial decision.

4. Volatility: Volatility measures the standard deviation or variance in daily returns of stocks. It serves as a proxy for risk, with less volatile stocks typically associated with lower risk. Stability and predictability are characteristics of companies with lower volatility.

5. Quality: Financial health is at the core of this factor, with the measurement relying on various leverage ratios. Quality-driven Smart Beta portfolios focus on companies with strong financial foundations.

6. Momentum: This factor assesses the rate of price change over a specific period. Investors analyze momentum to gauge the strength of a trend. Momentum stocks are those that align with the prevailing trend.

Types of Smart Beta Portfolios

Smart Beta portfolios are constructed with a specific focus, either targeting a single factor or seeking diversification through multifactor approaches:

1. Single Factor: These portfolios concentrate on a single factor that has historically driven returns over the long term. Common single factors include Value (discounted stocks), Quality (financially healthy companies), Momentum (stocks with an upward price trend), and Size (smaller, agile companies).

2. Multifactor: Multifactor portfolios aim to provide diversified exposure to a variety of factors. By encompassing multiple factors, these portfolios offer investors broader market exposure and risk management.

How to Implement Smart Beta Strategies

To incorporate Smart Beta strategies into your clients’ portfolios, consider these approaches:

1. Smart Beta ETFs (Exchange-Traded Funds): For a passive and cost-effective option, invest in Smart Beta ETFs. These funds replicate Smart Beta factors and provide diversified exposure to specific attributes. Some notable Smart Beta ETFs include VLUE, QUAL, MTUM, and SIZE.

2. Smart Beta Mutual Funds: Opt for Smart Beta mutual funds for a more active but relatively expensive approach. These funds are managed actively and aim to generate returns by strategically selecting companies based on Smart Beta factors. Examples of such funds include PXTIX and DSEEX.

In a rapidly evolving wealth management landscape, Smart Beta strategies have become a cornerstone of modern portfolio construction. By integrating these strategies with the advanced capabilities of Citec’s AI Smart Beta Screener, financial advisors can lead the way in the transformation of wealth management, providing clients with innovative and tailored investment solutions.

Unlock the Potential of Smart Beta with Citec’s AI Smart Beta Screener

Citec’s AI Smart Beta Screener offers financial advisors a robust solution to identify and apply Smart Beta strategies effectively. With the ability to screen and select stocks based on Smart Beta factors, Citec’s AI Smart Beta Screener empowers advisors to construct portfolios that align with their clients’ unique investment objectives and market vision. By leveraging this cutting-edge tool, financial advisors can deliver superior portfolio customization and optimization, ensuring their clients’ financial goals are not merely met but exceeded.