In today’s digital age, where data is king and technology drives business innovation, the disconnect between the CIO department and financial advisors represents a missed opportunity for organizations to harness the full potential of their resources. According to a survey conducted by Gartner, the leading research and advisory company, successful digital transformation initiatives require strong collaboration between IT and business leaders, including financial advisors. Yet, despite the growing recognition of technology’s importance in financial decision-making, many organizations struggle to bridge the gap between these two critical departments.

One of the primary reasons for this disconnect lies in the differing priorities and perspectives of CIOs and financial advisors. While CIOs are focused on optimizing technology infrastructure, implementing cybersecurity measures, and leveraging data analytics for business insights, financial advisors prioritize client relationships, investment strategies, and risk management. Without clear communication and alignment of goals, these divergent priorities can lead to misunderstandings and inefficiencies in decision-making processes.

Key Insights

- Strained Relationships: Research from Forbes Tech Council[^2^] indicates that only 30% of CIOs report having a robust working relationship with their Chief Financial Officers (CFOs). This statistic highlights a potential disconnect between the CIO department and financial advisors, who often collaborate closely with the CFO. Despite the increasing strategic importance of technology in finance, there remains a gap in communication and alignment between these two crucial departments.

- Common Challenges: Deloitte WSJ[^3^] identifies governance, ROI assessment, portfolio management, and communication as the primary challenges shaping CIO-CFO relationships. These challenges likely extend to the relationship between the CIO department and financial advisors. Without effective governance structures, clear ROI metrics, robust portfolio management practices, and open communication channels, collaboration between these departments may suffer.

- Collaboration Dynamics: EY Consulting[^4^] emphasizes the importance of collaboration between the CIO and CFO in providing essential analytics, reporting, and visualization tools to facilitate critical decision-making. However, a disjointed relationship between the CIO department and financial advisors could hinder the effectiveness of this collaboration. Without alignment on strategic priorities and goals, efforts to leverage technology for financial advisory purposes may fall short.

- Big Spending, Small Outcomes: Spending on technology has outpaced revenue and cost growth of the industry over the last five years (9 percent versus 8 percent versus 7 percent, respectively, from 2016 to 2021), with a big jump in 2022 (19 percent year-over-year growth, versus 6 percent and 5 percent, respectively)[^8^]. But this spending does not translate to benefits, since most of the information extracted from these platforms by the CIO department gets lost in Drives, PDFs and calls. Not being able to transform research into actionable ideas and insights to improve portfolios and interactions with clients.

Moreover, while the CIO is tasked with providing essential analytics, reporting, and visualization tools to facilitate critical decisions, this collaboration may fall short if there is a disconnect between the CIO department and financial advisors. The inherent difference in focus between the CIO and Chief Digital Officer (CDO) functions—where the former tends to be inward-looking and technology-focused, while the latter adopts an outward-facing, business-centric approach—could further contribute to this divide.

The Role of CIO in Financial Advisory

In the realm of financial advisory, the role of the CIO has evolved beyond mere technological oversight to become more of a collaborative partner. Today’s CIOs are expected to serve as trusted advisors, advocating for other departments and aligning their strategies with broader business objectives. However, research suggests that less than 10 percent of today’s CIOs qualify as digital vanguards—leaders who effectively align business and digital strategies. This lack of digital leadership among CIOs may exacerbate the existing gap between the CIO department and financial advisors, limiting the potential for synergistic collaboration.

Like many areas of the financial sector, the role of the Chief Information Officer (CIO) has undergone a profound transformation. Once solely responsible for managing technology infrastructure, the modern CIO now plays a pivotal role in shaping strategic business decisions. However, amidst this evolution, a significant gap persists between the CIO department and financial advisors—a gap that can hinder effective decision-making and impact client outcomes.

How CITEC is Bridging the Gap

Furthermore, the rapid pace of technological innovation presents a challenge for both CIOs and financial advisors. As new tools and platforms emerge, CIOs must evaluate their potential impact on business operations and determine how best to integrate them into existing systems. Meanwhile, financial advisors must stay abreast of the latest technological trends and developments to remain competitive in the market. Failure to collaborate effectively can result in missed opportunities to leverage cutting-edge technology for financial analysis, portfolio management, and client engagement.

Investing in technology solutions that facilitate collaboration and information sharing can help bridge the gap between the CIO department and financial advisors. For example, integrated financial planning platforms, data analytics tools, and client relationship management systems can provide real-time insights and streamline communication between IT and finance teams. By leveraging these tools effectively, organizations can enhance decision-making processes, improve client satisfaction, and gain a competitive edge in the marketplace.

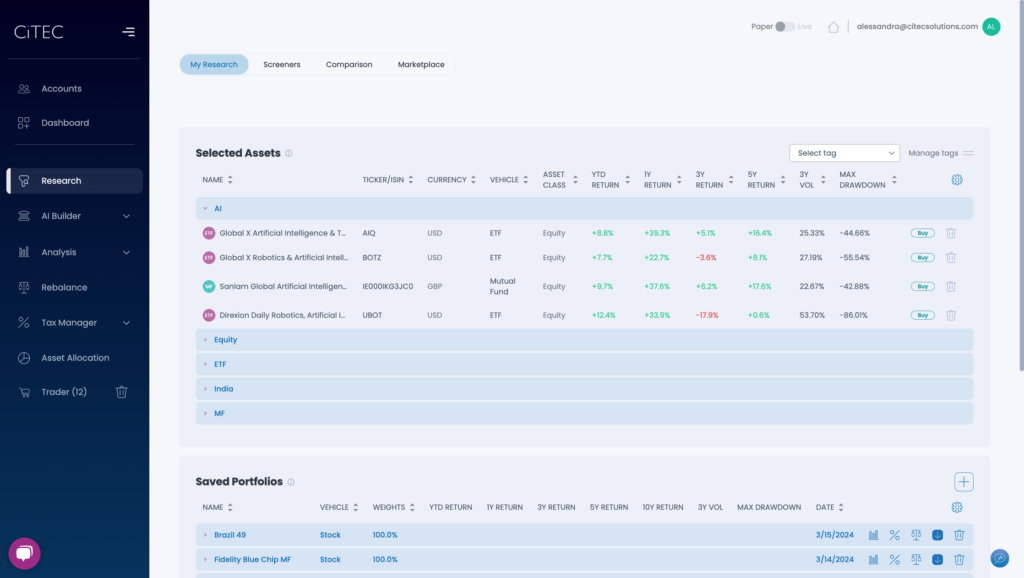

CITEC’s Research Hub

CITEC’s platform serves as a centralized hub where CIOs can extract valuable information from various sources and share it seamlessly with financial advisors in real-time. Through customizable dashboards, interactive visualizations, and collaborative features, CITEC enables CIOs to communicate key insights, investment strategies, and portfolio recommendations directly to financial advisors, fostering greater alignment and synergy between these departments.

Moreover, CITEC’s advanced analytics capabilities empower financial advisors to leverage data-driven insights to make informed investment decisions, manage client portfolios, and optimize performance. By providing access to comprehensive market research, trend analysis, and risk assessment tools, CITEC equips financial advisors with the information they need to deliver personalized investment strategies and superior client outcomes.

By bridging the gap between the CIO department and financial advisors, CITEC is revolutionizing the way organizations approach financial decision-making and client engagement. With its user-friendly interface, robust functionality, and seamless integration capabilities, CITEC enables organizations to unlock the full potential of their technology investments and drive innovation in the financial services industry.

Conclusion

The disconnect between the CIO department and financial advisors is multifaceted, stemming from the evolving role of the CIO, challenges in CIO-CFO relationships, and differences in focus between the CIO and CDO functions. To bridge this gap effectively, it is imperative for the CIO department to cultivate closer ties with financial advisors, aligning their strategies and goals to facilitate seamless collaboration and decision-making. By fostering a culture of openness, communication, and mutual understanding, organizations can leverage the collective expertise of their CIOs and financial advisors to drive innovation, optimize performance, and ultimately deliver superior outcomes for their clients.

In the age of digital transformation, where data-driven insights are paramount, closing the gap between the CIO department and financial advisors is not just a matter of convenience—it’s a strategic imperative for success in today’s dynamic business environment. Leveraging technologies like CITEC’s platform can make this transition a smooth change for the whole organization. Opening the doors to sharing information and reducing communication friction and loss.

Sources:

[^1^] Walkwater Talent Insights [^2^] Forbes Tech Council [^3^] Deloitte WSJ [^4^] EY Consulting [^5^] Atlan [^6^] The Enterprisers Project [^7^] Deloitte Insights [^8^] McKinsey